- California Probate Attorney | Trusted Legal Help for Estates and Real Property

- What Is Probate? A California Probate Attorney Explains

- What Is Probate Court?

- When Is Probate Required?

- When Is Probate Not Required?

- Understanding the Probate Process with a California Probate Attorney

- When Should You Hire a California Probate Attorney for Real Estate?

- Contact Schorr Law for Expert Probate Assistance

Updated on July 30, 2025

California Probate Attorney | Trusted Legal Help for Estates and Real Property

Imagine this: A loved one passes away, leaving behind a home, bank accounts, and personal belongings. As you begin to sort through their affairs, you quickly realize how important it is to understand the legal process—and when to contact a trusted California probate attorney. The stress of dealing with grief is now compounded by the complexities of the legal system. If this sounds overwhelming, you’re not alone. Many families face these challenges when navigating the probate process. But what is probate, and how does it affect you?

What Is Probate? A California Probate Attorney Explains

Probate is the legal process of settling a deceased person’s estate, including distributing their assets and paying any outstanding debts. It ensures that the rightful heirs receive their inheritance and that all financial obligations of the estate are met.

When someone dies with a will, probate serves to validate the document and oversee the execution of the decedent’s wishes. If the person dies without a will (intestate), probate determines the rightful heirs according to California’s intestacy laws. The process is supervised by a probate court, which ensures that assets are distributed fairly and legally. California Courts official probate self-help guide

What Is Probate Court?

Probate court is a specialized legal venue that handles the administration of estates after someone passes away. The court oversees the appointment of an executor (if there is a will) or an administrator (if there is no will) and ensures that debts, taxes, and other obligations are settled before assets are transferred to beneficiaries.

The probate court also resolves disputes that may arise, such as will contests, disagreements among heirs, or creditor claims against the estate. In California, probate proceedings typically take place in the county where the deceased resided.

When Is Probate Required?

Probate is generally required when a deceased person owns assets solely in their name without designated beneficiaries. Some common scenarios where probate is necessary include:

- The decedent owned real estate titled in their name alone.

- The total value of the probate estate exceeds California’s small estate threshold ($184,500 as of 2024).

- There are disputes over the validity of the will.

- The deceased had significant debts that must be addressed.

- Assets were not placed in a living trust or otherwise protected from probate.

When Is Probate Not Required?

Not all estates must go through probate. Some circumstances allow assets to pass directly to heirs without court involvement, including:

- Small Estates: In California, if the total value of the probate estate is below $184,500, heirs can use a simplified process to claim assets without formal probate.

- Joint Tenancy Property: Assets owned in joint tenancy automatically transfer to the surviving co-owner without probate.

- Living Trusts: Assets held in a properly funded revocable living trust avoid probate because they are legally owned by the trust, not the individual.

- Payable-on-Death (POD) or Transfer-on-Death (TOD) Accounts: Bank accounts, retirement funds, and investment accounts with designated beneficiaries pass directly to the named individuals.

- Life Insurance and Retirement Accounts: These assets transfer to the named beneficiaries outside of probate.

Understanding the Probate Process with a California Probate Attorney

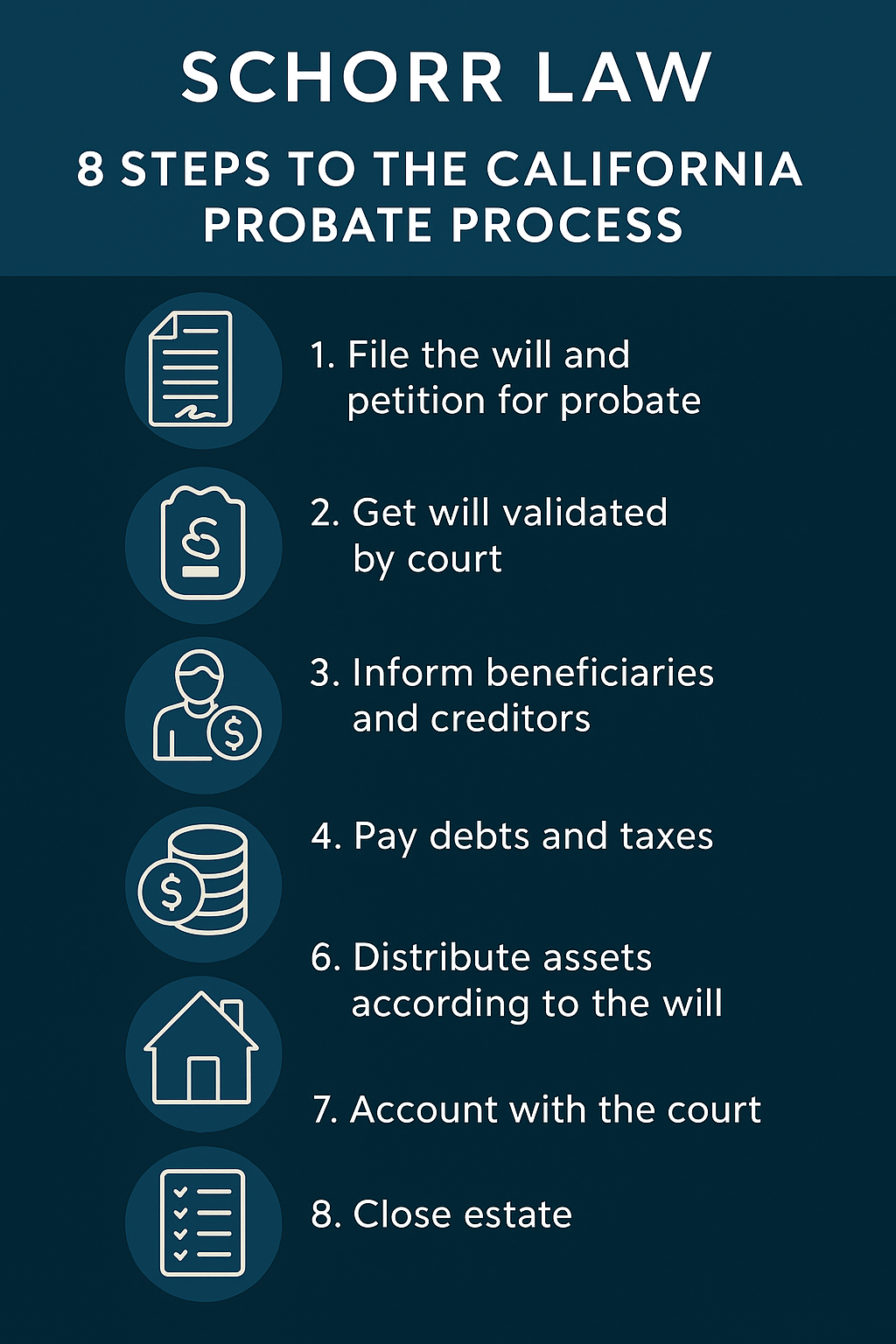

Working with a skilled California probate attorney during this process can help prevent costly delays and ensure everything is handled properly. The probate process in California can be lengthy and complex. It begins with filing a petition with the probate court to initiate the proceedings. The petition requests the appointment of an executor if there is a will or an administrator if there is no will. Once filed, a hearing date is set where the court formally appoints the estate representative.

After the petition is filed, the court requires notification to all heirs, beneficiaries, and known creditors. This step allows interested parties to come forward with any claims, disputes, or objections regarding the will or estate administration. Creditors are given a set period to submit claims for outstanding debts owed by the deceased.

An inventory and appraisal of the estate’s assets must then be completed. The executor or administrator is responsible for identifying all property, bank accounts, real estate, investments, and personal belongings of the decedent. In some cases, professional appraisers are required to determine the fair market value of certain assets.

Before any distribution can take place, outstanding debts and taxes must be settled. This includes federal and state income taxes, property taxes, and any other financial obligations left by the deceased. If the estate lacks sufficient funds to cover all debts, assets may need to be liquidated to satisfy the creditors.

Once debts and taxes are addressed, the remaining assets are distributed to the rightful heirs or beneficiaries as outlined in the will or under California intestacy laws if no will exists. This step often requires court approval to ensure that distributions are carried out properly.

Finally, after all necessary actions are completed, the executor or administrator files a petition to close the estate. The probate court reviews the actions taken, ensuring compliance with all legal requirements. If approved, the estate is officially closed, and the executor is relieved of their duties.

When Should You Hire a California Probate Attorney for Real Estate?

Why a California Probate Attorney Is Essential for Complex Estates

Handling real estate within probate can be particularly complex, making it essential to hire an attorney when property is involved. If the estate includes real estate assets that need to be transferred, sold, or managed, a probate attorney can help navigate legal requirements and ensure a smooth transaction.

Disputes among heirs or beneficiaries can quickly escalate, leading to contested probate proceedings. An attorney can help mediate these disputes, represent your interests in court, and ensure a fair resolution that aligns with California probate laws. Additionally, if the executor is unsure how to handle creditor claims or tax obligations, a lawyer can provide valuable guidance on settling debts and avoiding penalties.

When the deceased owned property in multiple states, ancillary probate may be necessary, adding further complexity to the process. A probate attorney can streamline these proceedings and help coordinate estate administration across different jurisdictions.

Mistakes in probate can lead to delays, legal challenges, or financial losses. Hiring an experienced probate real estate attorney can help avoid these pitfalls, ensuring the process is completed efficiently and in compliance with California law. For more information read: California Department of Consumer Affairs: Guide to Wills and Trusts

Contact Schorr Law for Expert Probate Assistance

Navigating probate can be stressful, especially during a time of grief. At Schorr Law in Los Angeles, our experienced probate attorneys are here to guide you through the process, from filing court petitions to handling real estate matters. Whether you need assistance with a contested will, property disputes, or simply ensuring a smooth probate process, we’re here to help.

Don’t let probate overwhelm you—contact Schorr Law today for a consultation and let us handle the legal complexities while you focus on what truly matters. Call us today at 310-954-1877 or fill out our contact form here.